|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

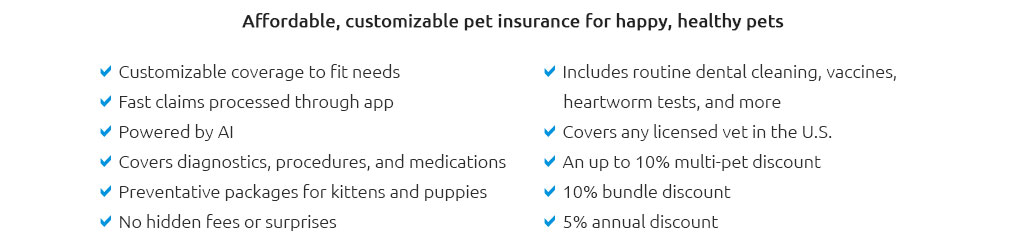

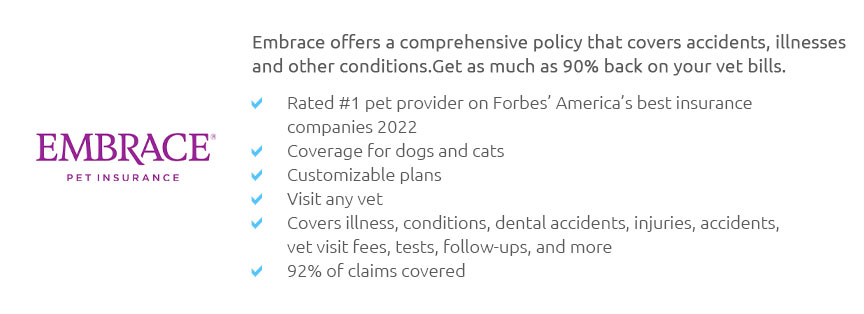

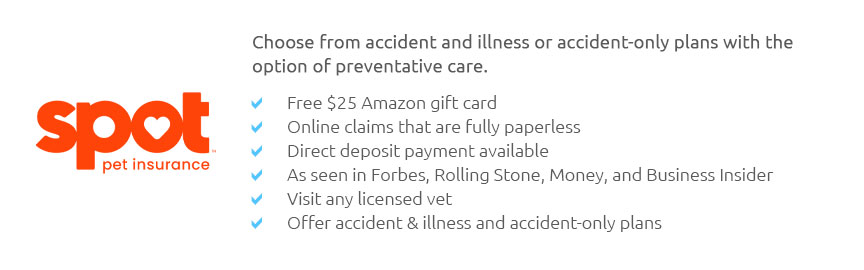

Understanding the Essentials of Health Pet Insurance: A Comprehensive GuideIn the ever-evolving world of pet care, the concept of health pet insurance has become a topic of increasing relevance. As devoted pet owners, we constantly seek to provide our furry companions with the best possible care, and understanding the nuances of pet insurance is an essential part of this journey. This article seeks to illuminate the often complex landscape of health pet insurance, offering insights that will help you make informed decisions. To begin with, health pet insurance is a policy purchased by pet owners to cover unforeseen veterinary expenses. Just as health insurance for humans offers financial protection against medical costs, pet insurance serves a similar purpose, albeit tailored to the unique needs of animals. The financial burdens associated with pet healthcare can be daunting, with routine check-ups, vaccinations, and unexpected emergencies adding up to substantial sums. Therefore, having a robust pet insurance policy can alleviate some of these financial pressures, allowing you to focus on the well-being of your pet without the constant worry of mounting veterinary bills. But why has pet insurance gained such prominence in recent years? The answer lies in the evolving perception of pets within our households. No longer are they merely companions; they are family members deserving of the same level of care and attention as any human. This shift in mindset is reflected in the rising demand for comprehensive health coverage that ensures pets receive timely and appropriate medical attention. Moreover, with advances in veterinary medicine, treatments that were once deemed impossible are now available, albeit at a cost. Pet insurance provides a buffer, enabling access to cutting-edge medical interventions without the prohibitive expense. Choosing the right pet insurance can be a daunting task, given the plethora of options available in the market. Policies vary significantly in terms of coverage, premiums, and exclusions, making it crucial to conduct thorough research before committing. Factors to consider include the types of coverage offered-such as accident-only, time-limited, or lifetime coverage-as well as the extent of coverage for conditions such as dental care, chronic illnesses, and alternative therapies. Additionally, it's important to scrutinize the fine print for exclusions that could affect claims, such as pre-existing conditions or breed-specific ailments. Another vital consideration is the cost of premiums. While it's tempting to opt for the cheapest option, it's essential to balance affordability with the breadth of coverage. In some cases, a slightly higher premium may offer significantly better protection, ultimately proving more cost-effective in the long run. Furthermore, many insurers offer customizable plans that allow you to tailor the policy to your pet's specific needs, a feature that can enhance the value of the insurance. It's also worth noting that while pet insurance provides a safety net, it should not replace routine preventive care. Regular check-ups, vaccinations, and a healthy lifestyle remain crucial components of your pet's overall health strategy. Insurance should be seen as a complementary measure, ensuring that unexpected health issues do not derail your pet's care plan. In conclusion, health pet insurance is an invaluable tool for responsible pet ownership, offering peace of mind and financial security. By taking the time to understand your options and choosing a policy that aligns with your pet's needs, you can ensure that your beloved animal receives the care they deserve, without compromise. As with any insurance product, due diligence is key, and the effort invested in researching and selecting the right plan will pay dividends in the quality of life you can provide for your pet. In the words of countless pet owners who have navigated the complexities of health pet insurance, 'It's not just about the money; it's about the love and commitment we owe to our pets.' https://www.statefarm.com/insurance/pet

We treat our pets like family, so we want them to get quality medical care when they are sick or injured. Trupanion helps provide cats and dogs coverage and ... https://www.aspcapetinsurance.com/

It covers the eligible costs of treating accidents and illnesses. Helpful resources for pet parents. View articles. Dog ... https://www.akcpetinsurance.com/

AKC Pet Insurance offers pet insurance to both cats and dogs of all ages and breeds. Get a free quote from our calculator today or call us at 866-725-2747.

|